As the U.S. moves closer to the 2024 election, one critical economic issue that hasn’t received enough attention is the national debt. Both Trump and Harris represent different visions for America’s fiscal future, yet neither has made the debt a central focus of their campaigns. In this analysis, we explore the economic implications of each candidate’s approach to taxes, spending, and tariffs, highlighting their potential impact on the national debt. While it is not our intention to wade into contentious political waters with this topic, we do believe it is necessary to explore the potential outcomes of the candidates’ policies on our economy, and by extension, our investments.

Neither Candidate Wants to Discuss the Debt

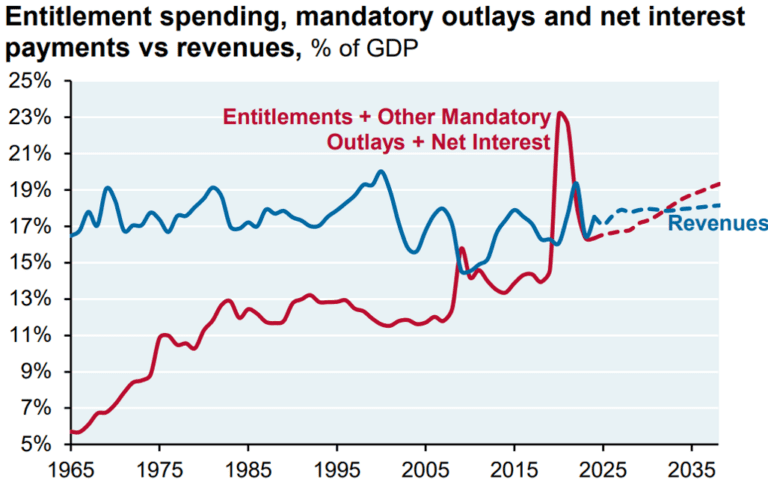

Despite the urgency of the national debt issue, neither candidate seems interested in addressing it directly. This omission is understandable from a political perspective, as discussing budget cuts to entitlement programs like Social Security and Medicare remains highly unpopular. Nevertheless, if current trends continue without intervention, we are expected to reach a “crossover point” in the mid-2030s where entitlement spending and interest on the debt exceed federal tax revenue. This is a significant concern for the country, but neither candidate appears inclined to tackle it head-on.

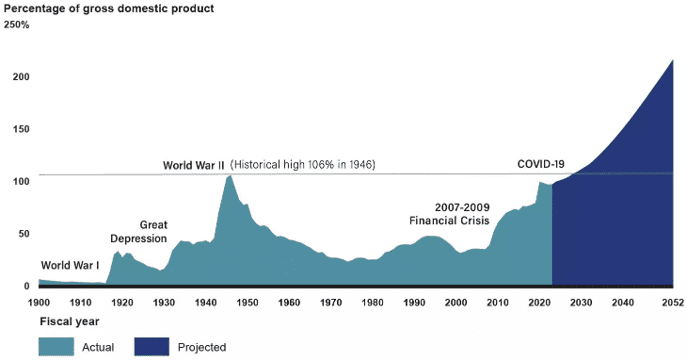

And the so called “crossover point” is not the only concern. Overall debt levels are projected to continue to rise based solely on current spending levels even before any new policies changes are made. In fact, the current trajectory shows the national debt rising to 200% of GDP by 2050, which is a level that used to be reserved for “basket case” countries like Greece, Japan, and Italy, not the strongest economy in the world and the provider of the world’s reserve currency.

Different Approaches to Raising Revenue

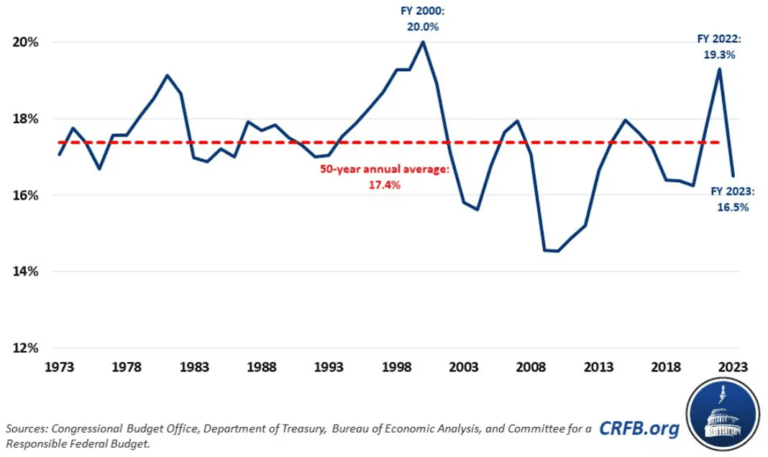

One area where the candidates do diverge is in their approaches to raising revenue. Harris, generally in alignment with Biden’s policies, favors higher taxes on high-income earners and corporations. In contrast, Trump advocates for broad tax cuts and aims to compensate with increased tariffs—a relatively novel approach for the U.S., which hasn’t relied significantly on tariffs for revenue in recent years.

Despite their differences, the actual revenue impact of both approaches has remained close to historical averages over the last eight years. The one notable exception came when revenue surged between 2021-2022, driven by capital gains taxes as a result of the Covid-related economic stimulus, low interest rates, and speculative market activity. However, this increase was a temporary spike arguably not related to tax policy, and revenue has since returned to traditional levels.

Total Federal Tax Revenue as a Percentage of GDP

Which Candidate is Worse for the Debt?

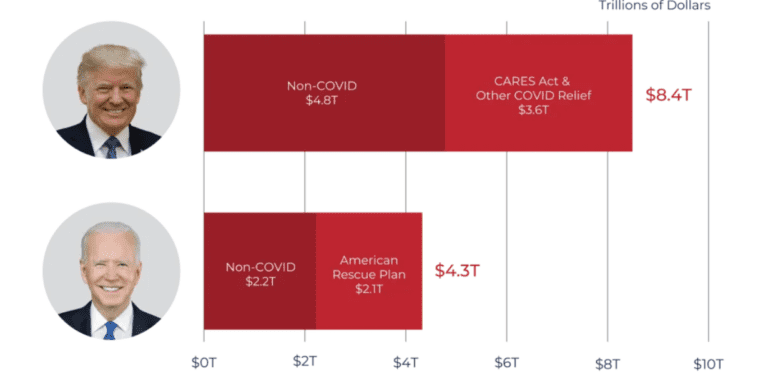

Examining past spending patterns, neither candidate appears particularly focused on reducing the national debt. Trump’s policies (excluding Covid relief) have contributed around $5 trillion to the debt over a ten-year period. Biden’s policies, if you include the American Rescue Plan, have also added similarly to the debt, though there’s some debate over whether the ARP should be considered Covid-related spending. Regardless, both candidates have pursued policies that increase the debt with little focus on debt reduction.

How Much Would a Trump or Harris Presidency Add to the Debt?

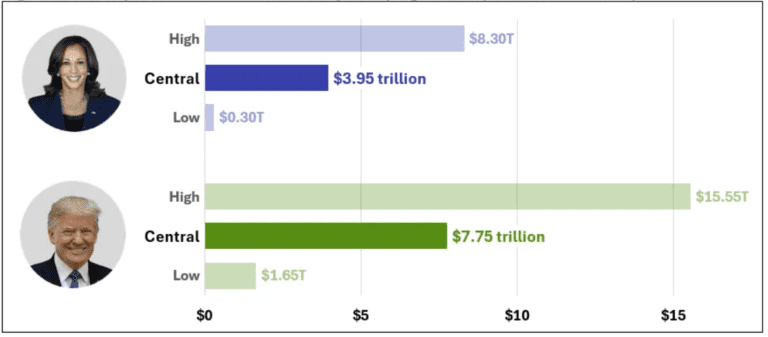

Given the difficulty of predicting specific economic policies, economists have projected that both candidates’ proposals would likely add to the national debt. Harris’ approach centers on raising taxes on higher-income earners and corporations, which she argues would allow middle-income tax relief. On the other hand, Trump’s focus remains on across-the-board tax cuts with an increased reliance on tariffs. However, accurately scoring tariffs is challenging due to potential secondary economic impacts, making their actual fiscal impact uncertain.

The Reagan era offers an insightful historical comparison. Concerned about Japanese automakers, the Reagan administration limited imported Japanese cars rather than imposing tariffs. This led Japanese automakers to build factories in the U.S., preserving American jobs. Trump’s approach differs, aiming to achieve similar results through tariffs rather than quotas, and there is a possibility that tariffs encourage domestic manufacturing. On the other hand, there is a question about the long-term impact of tariffs on U.S. protectionism and inflation.

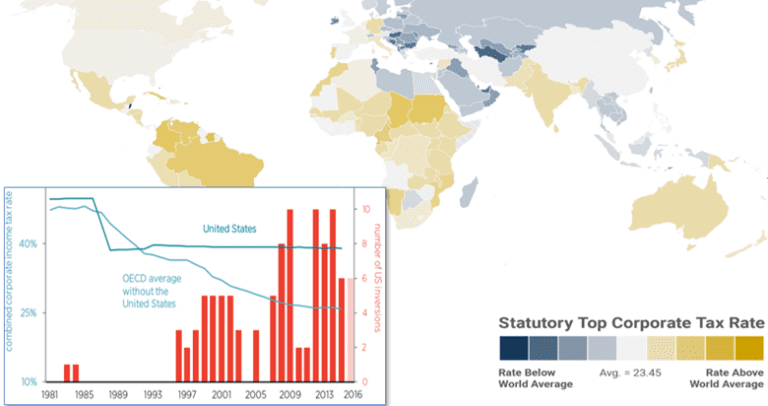

Corporate Tax Rates: A Point of Contention

The U.S. once had a relatively high corporate tax rate, which led some multinational corporations to shift headquarters to lower-tax jurisdictions—a practice known as corporate inversion. The 2017 tax cuts halted this trend by lowering corporate tax rates, making it a successful policy from that perspective. However, Harris proposes increasing corporate taxes, a shift that could have significant implications. Currently, the U.S. corporate tax rate aligns with global averages, but an increase could potentially revive incentives for corporations to seek tax relief overseas.

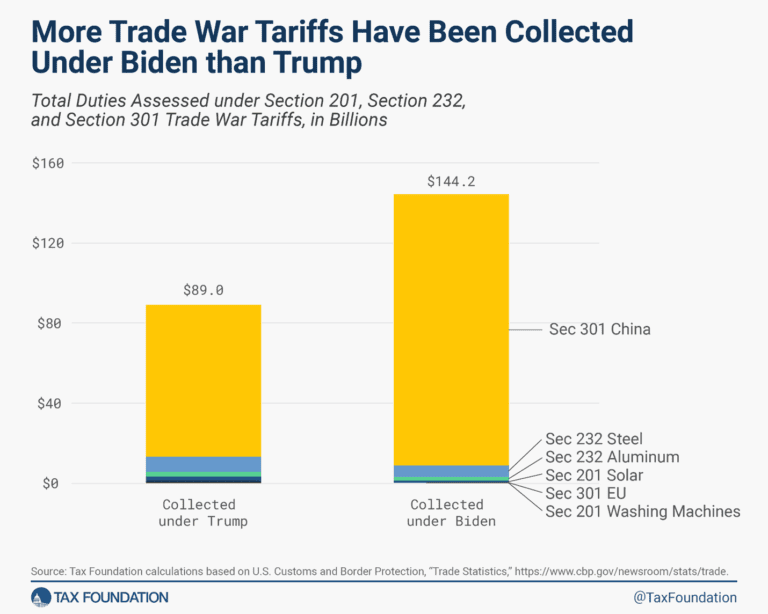

Bipartisan Agreement on Tariffs, with Differences in Degree

One unexpected area of bipartisan agreement has recently coalesced around tariffs, particularly those targeting China. While Trump proposes raising tariffs to 60% on Chinese imports if elected, the Biden administration has maintained and even increased tariff revenues compared to Trump’s first term. Despite these measures, the U.S. remains a relatively open market, with tariffs contributing minimally to government revenue. Even with a proposed increase in tariffs, it is unlikely that the U.S. would become a highly protectionist nation relative to global standards.

Conclusion

While Trump and Harris take contrasting approaches to revenue generation and corporate tax policy, both ultimately appear willing to add to the national debt without directly addressing its long-term implications. With entitlement spending and interest costs on the rise, the need for fiscal reform becomes more urgent each year. However, the political risks associated with addressing the national debt mean that, for now, both candidates are likely to avoid making it a primary focus.

As we head into the election season, understanding each candidate’s approach to fiscal policy can help investors make informed choices. While both candidates’ policies may yield economic benefits, the question of long-term debt sustainability remains open—an issue that may become increasingly difficult to ignore in the years ahead.