Investing in the Artificial Intelligence Theme

On November 30, 2022, the world first version of modern artificial intelligence (AI) was released into the world. Often called the “ChatGPT Moment,” when OpenAI released the first version of their revolutionary chatbot, ChatGPT, it captured the world’s imagination more rapidly than perhaps any other technological breakthrough before it. This groundbreaking event not only showcased the remarkable capabilities of AI but also served as a wake-up call to the investing world about its transformative potential. Since then, AI has become a defining theme in the stock market, driving innovation and reshaping industries.

With its rapid adoption and integration across various sectors, AI has become a focal point for investors. However, as with any significant technological trend, it’s essential to navigate opportunities and risks thoughtfully. This blog explores the key aspects of investing in the AI trend, highlighting opportunities, challenges, and the broader market implications.

The Role of AI in the Current Market

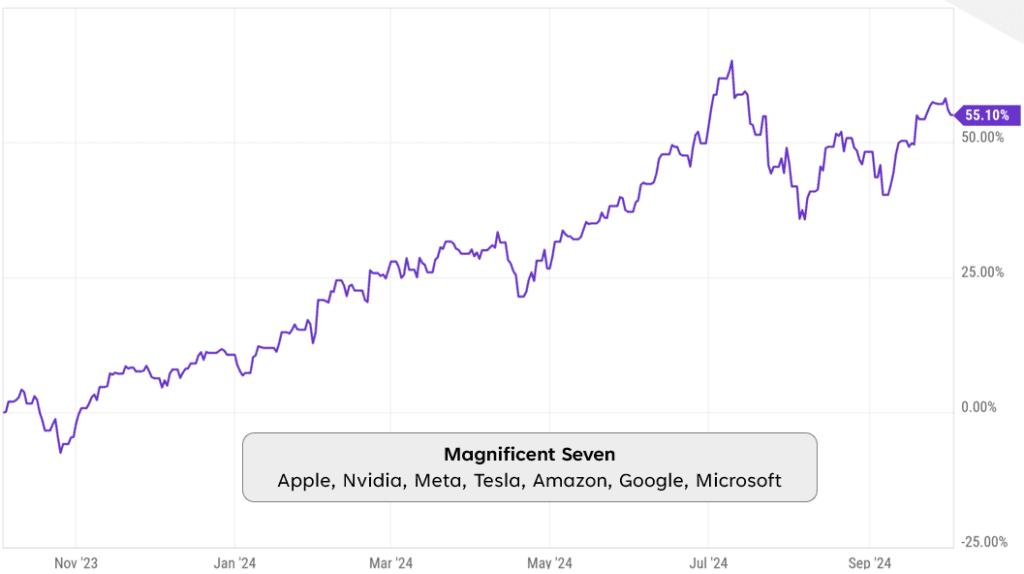

AI has driven remarkable returns in the stock market, particularly through a small collection of some of the largest technology companies in the world—Apple, Nvidia, Meta, Tesla, Amazon, Google, and Microsoft. Often referred to as the “Magnificent 7,” these companies have significantly outperformed most broader indices over the past year, as illustrated in the chart below. For comparison, the S&P 500 has risen about half as much over the same time period.

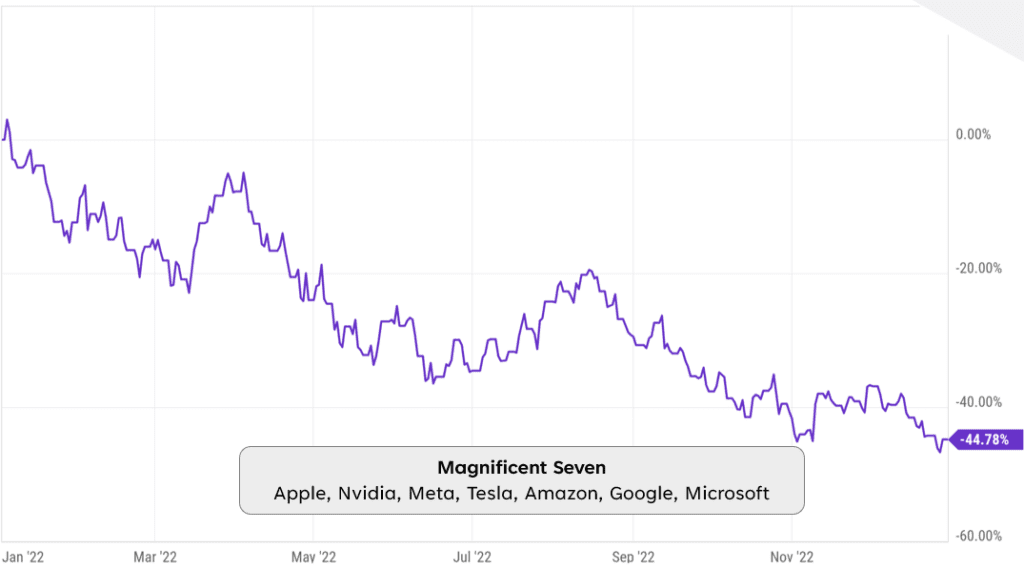

However, growth stocks, including these giants, are often known for their volatility. While they offer exciting opportunities, they can also pose risks, particularly during market downturns. As you can see from the chart below, in the last bear market in 2022 when the S&P 500 dropped about 20% or so, the “Magnificent 7” cohort was down more than twice that amount.

Market Concentration and Valuation Concerns

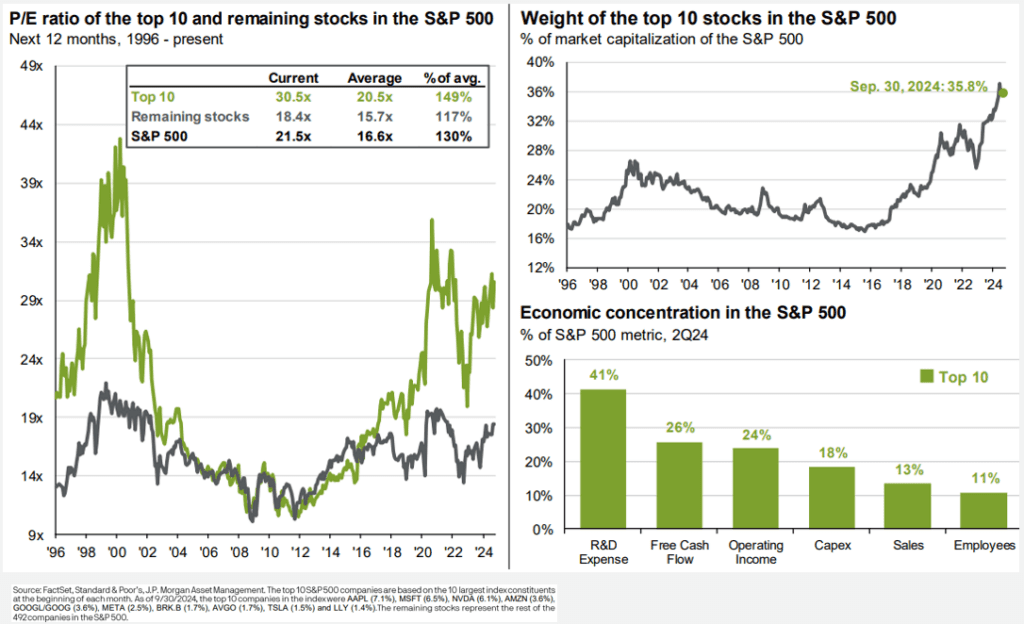

One of the most critical aspects of the current market environment is its concentration. The top 10 stocks in the S&P 500 now make up over 35% of the index’s market capitalization—a level not seen in many decades. In addition, these same 10 companies, which includes the “Magnificent Seven” by the way, are trading a valuations similar to the environments of the late 90s and 2020-21, and in both of those occasions, a bear market was not far away. While a high valuation does not necessarily mean the market will crash tomorrow, it does typically correspond to a deeper downturn in the case a bear market does appear.

The bottom line is the combination of high concentration and high valuations raises concerns about the potential vulnerability of the S&P 500 and similar market cap-weighted indexes. Investors should be aware of the risks hidden inside their portfolios, even within low cost index funds.

AI Fever and the Technology J-Curve

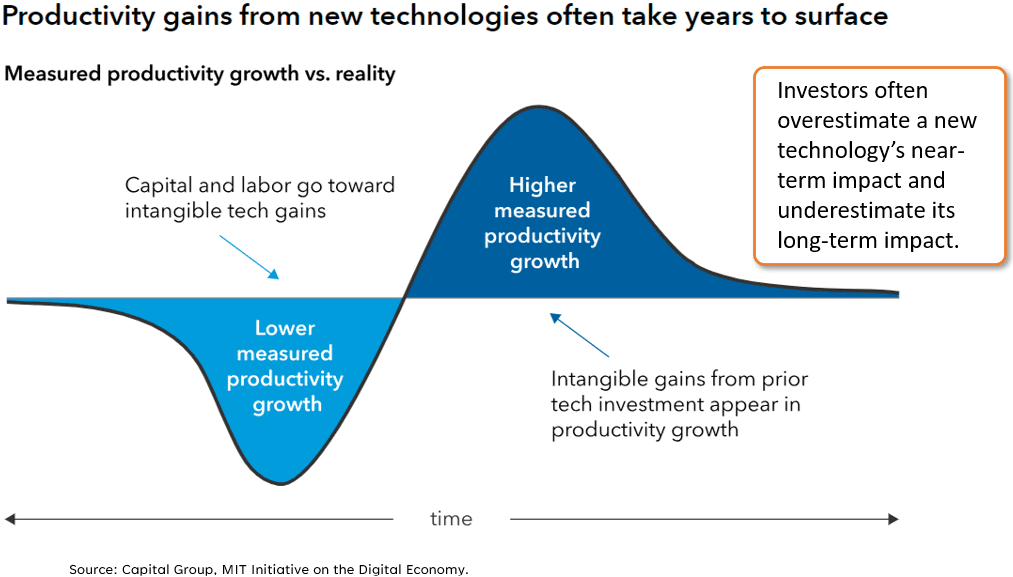

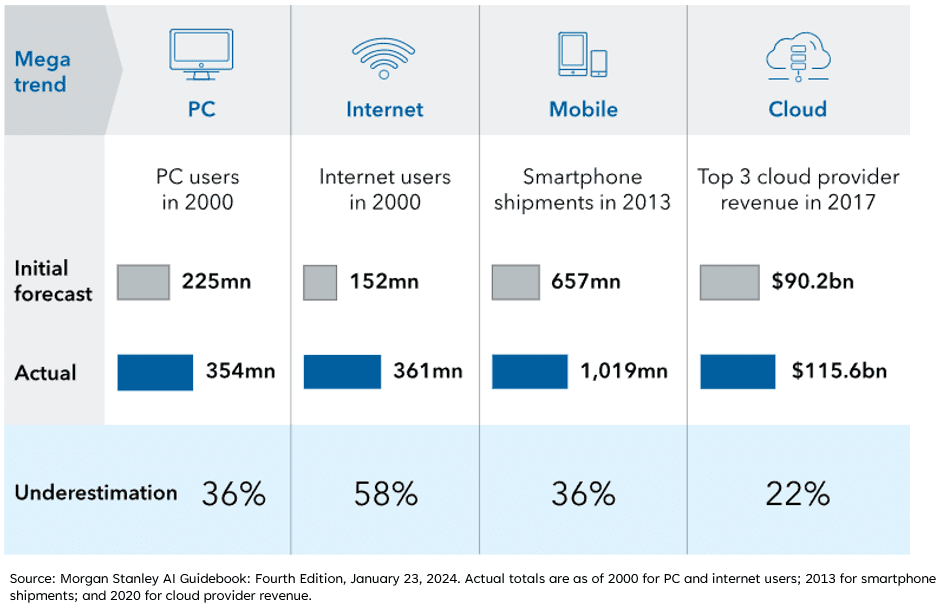

As with previous technological revolutions, AI follows a “J-Curve” adoption model. Initially, significant investments are required to build infrastructure and train systems, leading to lower productivity in the short term. However, as the technology matures, the benefits begin to outweigh the costs, driving substantial gains in productivity.

History has shown that investors often overestimate the near-term impact of emerging technologies while underestimating their long-term potential. We believe that AI will be no exception. While the excitement around AI is justified over the long-term, it is essential to remain realistic about timelines and growth trajectories.

The AI Technology Stack

The AI ecosystem can be broken down into four distinct layers, each offering unique investment opportunities:

- Chip Makers: Companies like Nvidia and Broadcom produce the advanced chips powering AI systems. These components are critical but the technology is constantly changing, making careful evaluation essential.

- Cloud Infrastructure: Major players such as Microsoft, Google, and Amazon provide the digital infrastructure to store and process AI data. Supporting companies, like Eaton Industries and Schneider Electric, which supply electrical equipment for data centers, also play a vital role. It is not necessary to only focus on the largest technology companies to get access to the “AI Trend.” If we look diligently, there are many ancillary players who will also benefit from the strong economic tailwinds of artificial intelligence.

- Large Language Models: Tools like ChatGPT, developed by OpenAI, have showcased the capabilities of AI in understanding and generating human-like text. Companies such as Microsoft, Google, and Meta are leading innovation in this space and building their own LLMs.

- End-User Applications: While consumer-facing AI applications are still emerging, companies like Tesla and Google are exploring transformative uses, such as full self-driving technology.

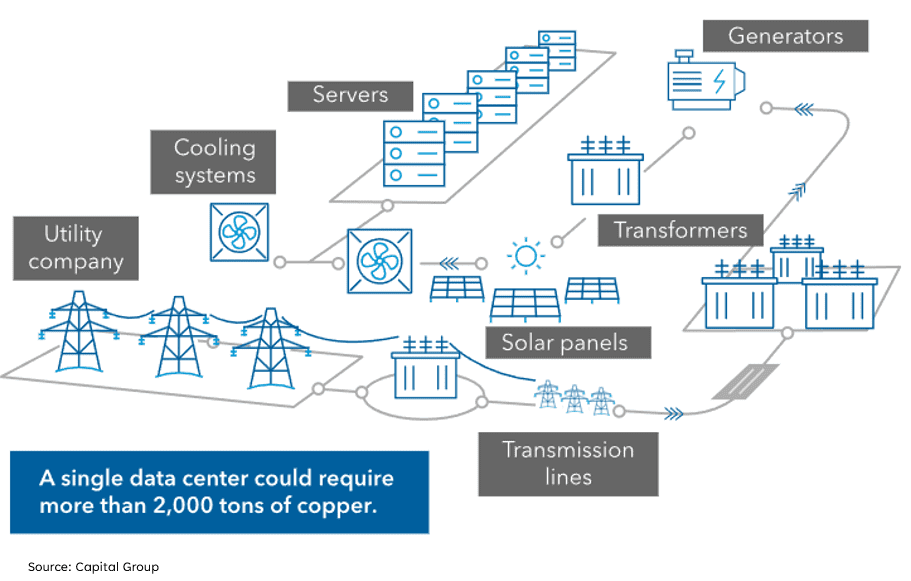

Data Centers: The Backbone of AI

Data centers are the engines of AI operations, housing the computing infrastructure needed to train and deploy AI systems. The anatomy of a data center involves a network of components, from utility companies to cooling systems and servers. Each of these components represents a potential investment opportunity. For example, increased demand for data centers translates into greater need for transformers, cooling systems, and other supporting technologies.

Is the Market Broadening Past AI?

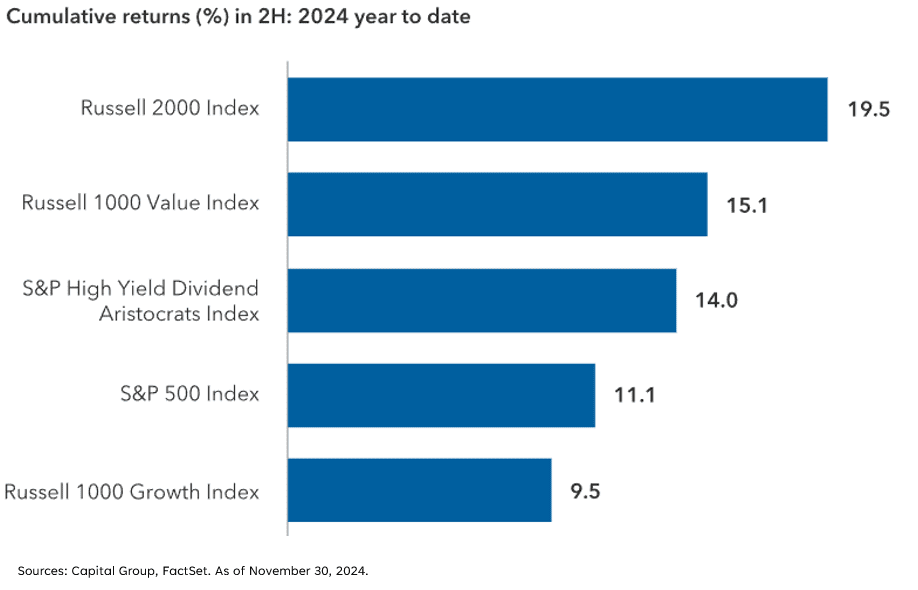

The market’s breadth has improved significantly in the latter half of 2024, with indices like the Russell 2000 and Russell 1000 Value outperforming growth-focused benchmarks. This diversification suggests that opportunities extend beyond large-cap technology stocks. By considering investments in small-cap and value-oriented stocks, investors can benefit from a more balanced exposure to the AI trend.

Conclusion

Artificial intelligence is reshaping industries and presenting unprecedented investment opportunities. However, the excitement around this transformative technology also comes with risks. A disciplined, diversified approach is essential to navigate the complexities of the AI investment landscape.

As the AI revolution unfolds, it will be crucial to focus on long-term potential while being mindful of short-term challenges. By understanding the layers of the AI technology stack and identifying diverse opportunities, investors can position themselves to capitalize on this exciting trend responsibly.

Note: Companies mentioned may be owned by clients of the firm. Nothing in this blog should be construed as a recommendation to buy or sell any investment. Not financial, tax, or legal advice. Please consult with a qualified professional before embarking on any investment strategy. Investments involve risk and may lose value, including the loss of principle. Past performance is not an indication of future results.