I recently hosted a webinar for my clients to dive into the topic of Trump’s tariff policies and what they might mean for the economy and financial markets. Today, I’m excited to share some of those insights in this blog post. Tariffs are a complex subject—full of economic nuances, political motivations, and market implications—but my goal here is to break it down in a way that’s digestible and relevant to your financial planning. We’ll explore the history behind today’s trade dynamics, the motivations driving these policies, their potential effects on inflation and stocks, and what it all means for your investments.

A Brief History of Globalization and the U.S. Trade Deficit

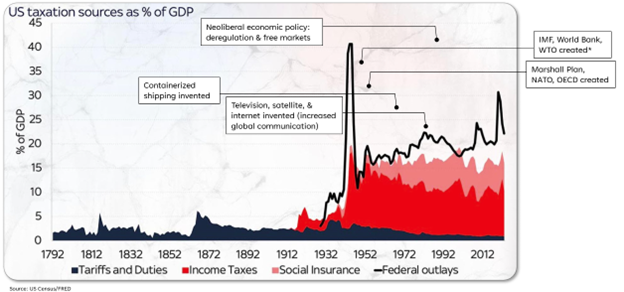

To understand where we are today with tariffs, we need to look back at how we got here. Globalization has been a defining trend of the 20th century, and it’s shaped the U.S. economy in profound ways. Take a look at the first chart from the webinar (you’ll see it embedded below). It’s a busy one, but it tells an important story. The dark blue line at the bottom shows tariffs and duties as a percentage of federal government revenue. Before the 20th century—and really before the World Wars—the U.S. government was 100% funded by tariffs. That’s a fact President Trump often highlights, and he’s correct. But since about 1970, that reliance has dropped dramatically as other revenue sources, like income taxes, took over.

This shift ties into the broader globalization story. Post-World War II, the U.S. emerged as a global leader, helping rebuild a war-torn world. The deal was simple: we’d protect global shipping lanes, act as the world’s police, and foster trade, while other nations adopted democratic systems and Western values. Institutions like the IMF, World Bank, WTO, and NATO sprang up to support this vision. Add in technological leaps—like containerized shipping and the internet—plus the neoliberal policies of the Reagan-Thatcher era, and you’ve got the recipe for a globalized economy.

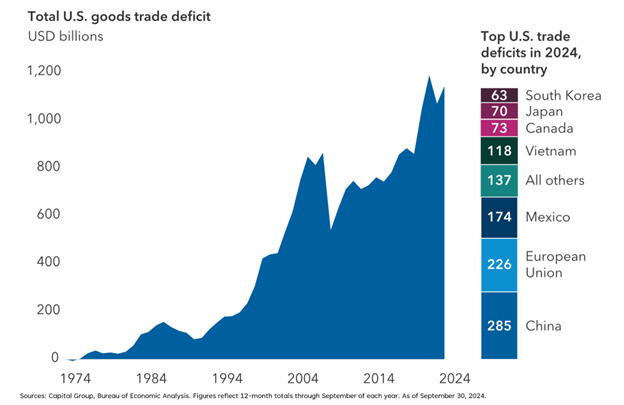

This system worked well for decades. The U.S. leveraged its military might to keep trade flowing, while countries like China became the world’s factory, capitalizing on their large, low-wage workforce. But there’s a flip side: the U.S. trade deficit ballooned. Another chart from the webinar shows this starkly—50 years ago, we barely had a trade deficit; now, it’s hit a trillion dollars annually. China leads the pack, followed by nations like South Korea, Japan, Canada, Vietnam, Mexico, and the EU. This imbalance has fueled concerns about “hollowing out” America’s manufacturing heartland, where jobs once accounted for 25% of the workforce but now hover in the single digits.

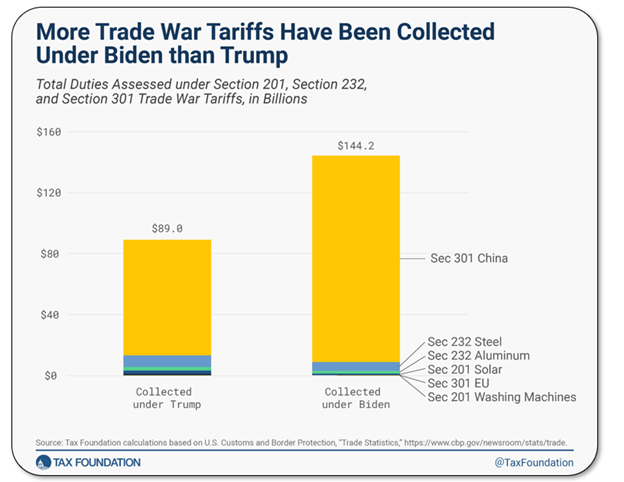

Interestingly, tariffs didn’t vanish under Biden. In fact, as the next chart shows, more tariff revenue was collected on Chinese goods during his administration than Trump’s first term—though COVID skewed the numbers a bit. This suggests some bipartisan support for protectionism, a shift from decades past when neither party cared much for it. I believe we’re at a turning point in U.S. policy—a move away from unfettered globalization toward something new.

Trump’s Tariff Motivations: Four Key Drivers

So, why tariffs now? Trump’s rhetoric on the campaign trail, in his first term, and in his nearly two months back in office (as of late March 2025) points to four distinct motivations. Understanding these helps us predict how tariffs might play out.

- Decoupling: This is about reducing reliance on certain countries—namely China—for critical supply chains. Think semiconductors or high-tech goods. The fear is geopolitical: if we’re too dependent on a rival like China, a World War III scenario could leave us without chips for everything from smartphones to hearing aids (my parents just got some, and those tiny devices are marvels of tech!). This motivation has bipartisan backing and isn’t going away.

- Rebalancing: Here’s the heart of the “America First” pitch—bringing manufacturing back to the U.S. to shrink the trade deficit and revive jobs in the Heartland. I think this resonates with enough Americans to make it a long-term trend, even if economists debate its efficacy. Countries like China, the EU, Japan, South Korea, and Vietnam are in the crosshairs.

- Negotiating: Tariffs as a stick to influence policy—like pressuring Mexico and Canada on immigration and fentanyl, or China on trade practices. It’s cheaper than military action, and Trump loves a deal. This feels more tactical than strategic, though—think short-term leverage rather than a permanent shift.

- Funding: With a federal deficit at 7% of GDP, tariffs could generate revenue to ease budgetary woes. Trump’s talked about this, and some advisors (like Howard Lutnick) see it as a big win. I’m skeptical it could replace the tax code—it’d take multiple terms to pull off—but it’s a motivator nonetheless.

Which of these matters most? I’d argue rebalancing is the top priority now, with decoupling simmering on the back burner (some China tariffs are already in place). Negotiating feels like an excuse for executive flexing, and funding is a nice-to-have but not transformative yet. How the administration weights these will shape what’s next.

Do Tariffs Cause Inflation? It’s Complicated

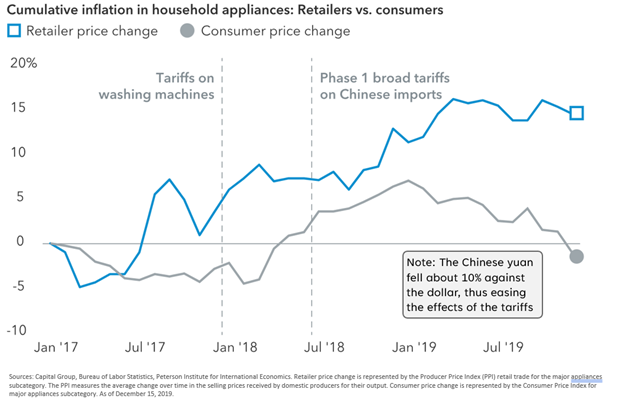

Now, let’s tackle a question the markets obsess over: do tariffs spark inflation? Look at the chart from Trump’s first term, tracking washing machine prices after tariffs hit. The blue line is what retailers paid (including tariffs), and the gray line is what consumers paid. When tariffs kicked in, retailer costs spiked, but consumer prices only bumped up temporarily before leveling off. Studies peg the pass-through at 30-50%—not a one-for-one hike. Why? Competition, currency shifts, and capacity play a role.

Take China’s yuan dropping 10% against the dollar during that period—it nullified much of the tariff’s bite. Consumer psychology matters, too. A one-time price jump? People shrug it off. But a tit-for-tat trade war with escalating tariffs? That could bake in expectations of higher inflation, driving demand and prices up further. I don’t see that happening—it’d force Trump to back off—but it’s a risk.

The takeaway? Tariffs don’t automatically mean runaway inflation. That washing machine chart shows a temporary blip, not a trend. Still, inflation’s a big deal—it pushes interest rates up, slows the economy, and can tip us into recession or stagflation. I’ve talked your ears off about this before, so I’ll move on!

Reciprocal Tariffs: What’s “Liberation Day” About?

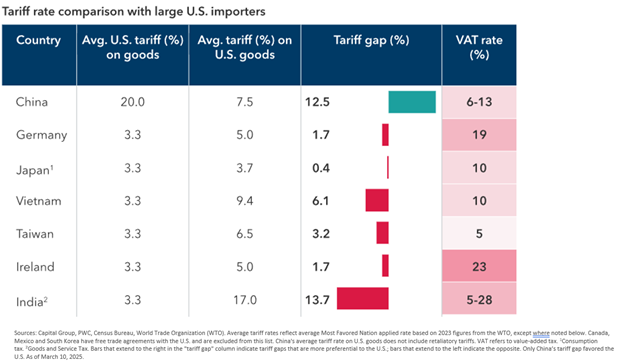

Trump’s latest buzzword is “reciprocal tariffs,” tied to his “Liberation Day” marketing for April 2, 2025—next week as I write this. The pitch is fairness: if other countries tariff us, we tariff them back. The chart comparing U.S. tariffs to others’ is eye-opening. China’s an outlier—we’re at 20% while they’re lower (though their VAT muddies the picture). Germany’s tariffs are nearly double ours, Vietnam’s triple, Taiwan and Ireland almost double, and India’s way higher (though trade there’s small). Japan’s close to us.

Reciprocal tariffs wouldn’t mean 50% rates—modest hikes could level the field. Trump might lump in VAT taxes (not technically tariffs, but he doesn’t care), broadening the scope. We’ll see what April 2 unveils, but expect headlines galore.

Lessons from Trump’s First Term

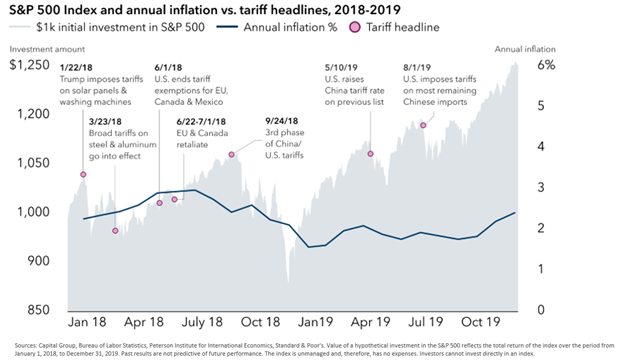

Let’s wrap up with a look back, courtesy of the final chart from the webinar. It tracks inflation (dark blue) and the S&P 500 (another line) during Trump’s first term. Inflation stayed tame—peaking near 3%, averaging low 2s—despite tariffs. Was it higher than without them? Probably, but we can’t prove it. The market? Volatile (that 20% drop in late 2018 still stings), but it climbed 25% over two years—a solid 12% annualized return, matching long-term averages.

What’s the lesson? Tariffs didn’t tank the economy or markets last time. Inflation ticked up but didn’t spiral, and stocks did fine despite the noise. Today, with inflation in the mid-to-high 2s, I’d expect a similar story—maybe hitting 3.5% at most, not 6-7%. Markets might not soar double digits in 2025 (we’re flat now, down a few percent), but I’m not forecasting a recession. The economy’s robust, and I’m cautiously optimistic—barring some black swan event.

Final Thoughts: Navigating Uncertainty

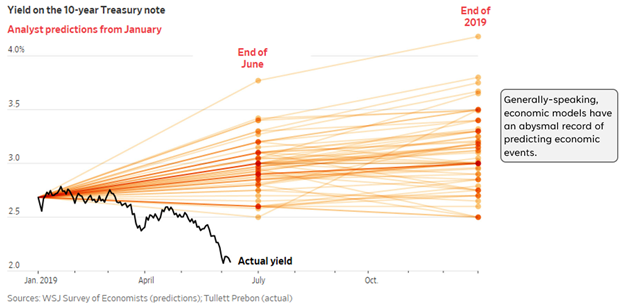

One last slide from the webinar: economic forecasts are notoriously unreliable. A Wall Street Journal study showed economists’ 10-year Treasury yield predictions were wildly off—nobody was close. Too many variables, too many second- and third-order effects. As investors, we can’t predict the future (if I had tomorrow’s Wall Street Journal, I’d be on a beach!). So, we stay diversified, avoid uncompensated risks, and stick to your personalized plan. That’s why we spend so much time understanding your goals—your portfolio should weather tariffs, volatility, or whatever comes next.

Expect a choppy 2025—tariff talks will dominate headlines, and I’m already tired of them. Negotiations will take time, but Trump’s team seems eager to move fast and broad. Rebalancing will drive the bus, with decoupling, negotiating, and funding along for the ride. Markets will react, but history suggests they’ll adapt.

Thanks for reading, and stay tuned for more insights!